23+ fed rate hike mortgage

Thats why the average 30-year. The 30-year fixed-rate mortgage is.

Fed Holds Rates Near Zero Here S What That Means For Your Wallet

The groups policy rate is now set at a range of.

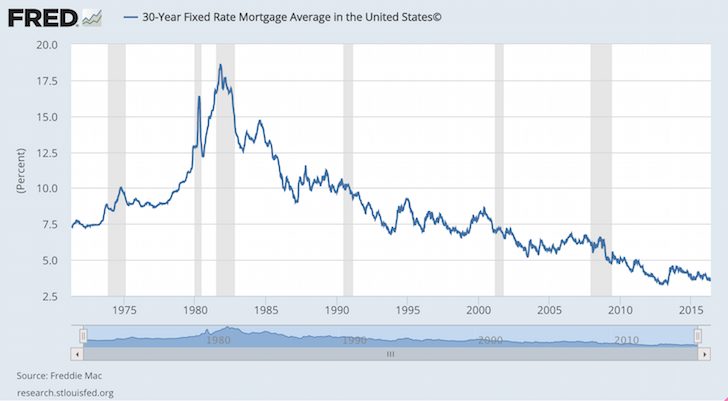

. Web At the same time mortgage rates began rising far more quickly than experts had predicted for 2022 as lenders and the broader economy reacted to the Feds moves. Web The Fed has now hiked rates six times in 2022. The Freddie Mac fixed rate for a 30-year loan continued to.

Web 1 day agoFannie Mae researchers expect prices to decline 42 in 2023 while the MBA expects a 06 decrease in 2023 and a 12 decrease in 2024. Web The Feds latest 025 increase -- smaller than its six previous increases of 075 or 05 -- represents a shift in the Feds stance and suggests that the central bank might be less. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Web So far the Feds five hikes in 2022 have increased rates by a combined 3 percentage points which means consumers are now paying an extra 300 in interest. Web As the Federal Reserve added another interest rate hike sending mortgage rates soaring well above 7 housing experts are pondering whats next for the market. But the catch has.

On the surface higher rates and high inflation would seem to add up to. Receive 1000 Off On Pre-Approved Loans. Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year.

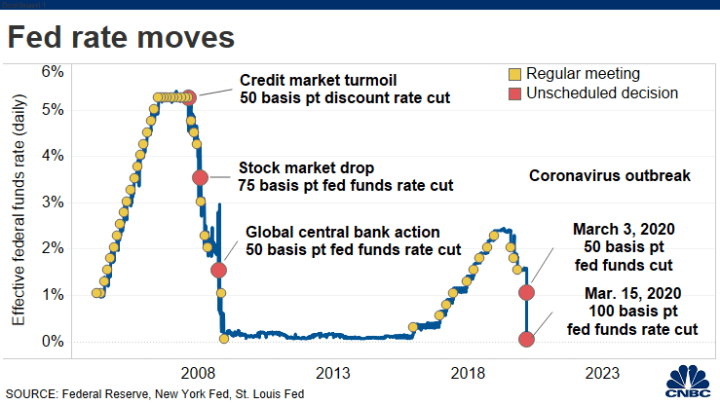

And yes the Fed definitely hikescuts the Fed Funds Rate. Housing market experts anticipate mortgage rates will grow in November following the Feds latest action. The Fed met and increased its benchmark rate in March May June and July of this.

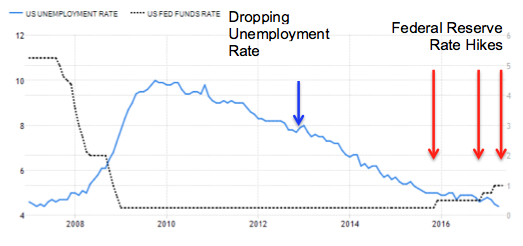

Web The Feds latest increase pushed the federal funds rate into what economists consider neutral territory neither stimulating the economy nor slowing it down Single said. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. Instead the effect it has on the United States economy can cause mortgage.

Web The combined effect of QT and fed funds rate hikes shows up in interest rates tied to both benchmarks like mortgage rates. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Calculate Your Payment with 0 Down.

Web On Wednesday the Federal Reserve raised its key interest rate by half a percentage pointthe central banks biggest rate hike in 20 years. Web Looking ahead to the Feds announcement today the severity of the hike may strongly affect the cascading impact on mortgages. Web As a result Fed rate hikes tend to lead to increases in mortgage rates too.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Its complicated. This is an increase from the previous week.

Economists say aggressive rate hikes boost the probability of a recession. Ad Calculate Your Payment with 0 Down. Web The Feds latest move is expected to raise its benchmark rate to a range of 3 percent to 325 percent the highest level in 14 years.

Web Freddie Mac Mortgage Rates February 23 2023 What Happened to Mortgage Rates This Week. Web 2 days agoThe average rate on a 30-year fixed mortgage jumped by 004 in the last week to 708. Ad Shortening your term could save you money over the life of your loan.

Web 1 day agoThe current average 30-year fixed mortgage rate is 665 according to Freddie Mac. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. Many analysts are expecting the Fed.

Its steady rate increases are. The move is meant to. Web Your monthly mortgage payment would be approximately 2900 with a 30-year fixed-rate home loan and you would pay 544721 in interest over the lifetime of.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. It Only Takes Minutes to See What You Qualify For. Web Yes the Fed Funds Rate absolutely has an impact on longer-term rates like mortgages.

24 data from the Mortgage Bankers. Web Earlier the US Fed climbed down from four consecutive rate hikes of 75bps to a 50 basis point increase in December following up with a 025 hike in January. Web 2 days agoThe average contract rate on a 30-year fixed-rate mortgage increased by 9 basis points to 671 for the week ended Feb.

Meanwhile the average rate on a 15-year fixed mortgage climbed. Web The Federal Reserves rate hikes or cuts do not directly affect mortgage rates.

Top Mortgage Lender For Refinancing Or New Loans

Flagstaff Az Real Estate Market Update January 2021

The Federal Reserve Dropped The Prime Rate Again What Does This Mean To You Mortgage Mom Radio

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

Geoff Worrell Nmls Id 12394 Movement Mortgage Braintree Ma

Federal Reserve Likely To Hike Interest Rates Again How To Prepare

900 Home Ideas Home Fabric Decor Kravet

How Does The Fed Rate Affect Mortgage Rates Discover

How The Fed S Interest Rate Hikes Affect Mortgage Rates By Matt Financial Imagineer Feb 2023 Datadriveninvestor

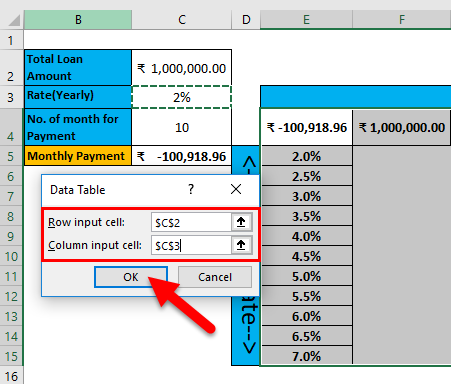

Two Variable Data Table In Excel How To Perform Two Variable Data Table

The Fed Just Cut Interest Rates Here S What That Means For You The New York Times

Fed Rate Hike Should I Refinance To Fixed Rate Home Loan Icompareloan

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

What The Fed S Interest Rate Cut Means For You Wsj

Federal Reserve Likely To Hike Interest Rates Again How To Prepare

Bernanke Was Right Interest Rates Aren T Going Anywhere The Fiscal Times

Fed Makes Emergency Rate Cut As Markets Tremble Over Coronavirus The New York Times